Self-Managed Super Fund

Brilliant…in the right circumstances

A Self-Managed Super Fund offers the ultimate in investment flexibility and has a huge take-up by people who want to be able to control what their superfund invests in.

But it isn’t for everyone. The investments might not deliver the returns you expect and the administrative requirements, including the obligation to provide an annual audit and tax return, cannot be ignored.

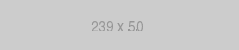

How much income will my super provide?

Download our free calculator.

Understanding your situation

Our starting point will always be “is an SMSF right for you?”

You might have specific assets you want included in a superfund, such as a property or collectibles. You might be self-employed and want to purchase your business premises so that your rent goes into your super and not to a third-party. You might have inherited some money or sold a business.

Whether an SMSF is the right solution for you will depend on your circumstances. Our job is to help you make the right decision.

Is an SMSF right for me?

An objective appraisal of the pros and cons followed by fund set-up and management if appropriate.

Asset Protection

If an SMSF is right for you, we can assist with setting up your SMSF and managing the investments. We can also connect you to a specialist SMSF administrator, or work with your existing accountant, to establish the SMSF Deed and handle the financial statements, audit and lodge the annual accounts.

If, on the other hand, an SMSF isn’t right, an industry or retail superfund may offer sufficient flexibility without the administrative burden and with lower costs, so we’ll discuss these too.

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!